For an in-depth look at the rules of property purchase, see our detailed guide.

A SIPP (Self-Invested Personal Pension) gives you greater flexibility over your pension investments, allowing you to hold a wider range of assets including certain types of property.

Investing in property through a SIPP can:

• Generate rental income for your pension through a flexible approach

• Offer potential capital growth

• Provide tax advantages on rent and gains within the pension for individual investors

• Help business owners purchase their own premises via their pension

Before purchasing property within a SIPP, it’s essential to obtain approval from your SIPP provider to ensure the investment meets HMRC requirements.

Learn more about what’s involved in property purchase, including:

• The due diligence and valuation process – crucial when buying property

• What types of property can be approved

• Common pitfalls to avoid when buying property

Learn more about ownership considerations in property purchase here.

Once a property is purchased within a SIPP, there are ongoing responsibilities, from managing leases and insurance to ensuring compliance with pension and property rules.

Our team provides ongoing administration and expert support to keep your SIPP property compliant and efficient.

Discover how commercial property works within a SIPP and the significant benefits it offers.

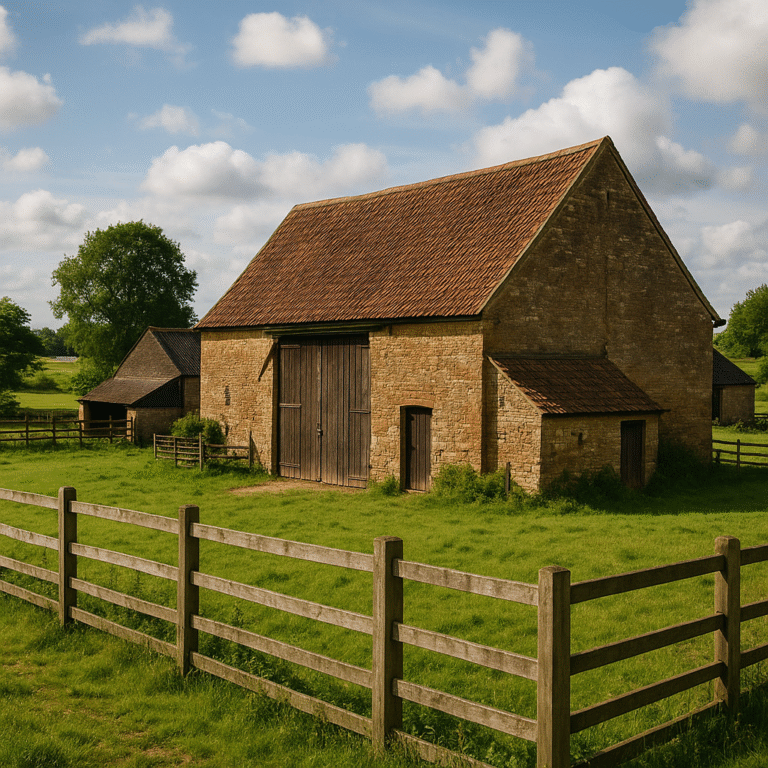

Commercial property is the most common asset type held within SIPPs. This includes offices, retail units, industrial premises, and land.

You can:

• Purchase property directly through your SIPP

• Lease it back to your own business (under market terms)

• Benefit from tax reliefs on rental income and property growth

Find UK based SIPP Providers that allow members to buy property in a SIPP including Alltrust.

The UK market includes several Property SIPP providers. This guide takes a looks at what is important when considering a provider that allows property in a SIPP such as:

• Transparent fees

• A dedicated in house property team with the right expertise

• Clear communication and support with aquiring property in a SIPP

Understand the rules you need to be aware of when using a SIPP to own commercial property.

What are the rules that govern the aquisition of property in a SIPP? This guide looks at the rules and all parties concerned, including:

• HMRC regulations

• Connected party restrictions

• Trustee responsibilities

Discover the process for transferring a commercial property into a SIPP.

Transferring a property into a SIPP requires careful planning. This guide walks you through the process for the transfer of property to a SIPP including:

• Appointing an adviser and choosing a suitable SIPP Provider

• Obtaining an independent valuation

• Compliance with HMRC rules and legalities of completing the purchase or transfer

• Payment of any applicable stamp duty and fees

• Registering the property under the SIPP trustee

This information is provided for general guidance only and should not be considered financial advice. You should seek independent, qualified financial advice before making any investment decisions.